Donor Stories

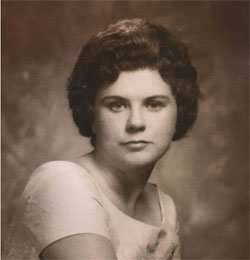

Georgian Wavle: Leaving a Legacy for the Birds She Loved

Georgian Wavle: Leaving a Legacy for the Birds She Loved

Georgian Wavle loved to bird. She travelled all over the world to pursue her passion, and she followed the birds to Corpus Christi on the Texas Gulf Coast for her retirement years. The Coastal Bend is known for its incredible array of resident and migratory birds, many of which can be seen at nearby state parks, including Goose Island, Mustang Island, and Lake Corpus Christi.

Read More

Ray Garcia: Leaving a Legacy for our Natural World

Ray Garcia: Leaving a Legacy for our Natural World

Ray Garcia has lived a full and fulfilling life that has taken him far from the Fifth Ward of Houston where he grew up. Ray learned the value of hard work and the importance of education from his parents, teachers and counselors.

Read More

Lynise Marshall & Steve Scott: Sharing a Passion for Parks

Lynise Marshall & Steve Scott: Sharing a Passion for Parks

Lynise Marshall shared a passion for the outdoors with her late husband, Steve Scott. He grew up visiting state parks across Texas, and when Steve and Lynise got together, the two spent many happy days road tripping to parks from their home base near Houston. They also had many travel adventures all over the world.

Read More

Steve Boles & Vicki Giere: Supporting Women Seeking Conservation Careers

Steve Boles & Vicki Giere: Supporting Women Seeking Conservation Careers

Steve Boles spent the last part of his professional career working in the river studies program for Texas Parks and Wildlife Department. He joined the agency in 1996 and retired in 2015. There was one thing he noticed about his agency colleagues, and now he and his wife, Vicki Giere, want to do something about it.

Read More

Elaine & Bobby Cowley: Paying it Forward for Our Parks

Elaine & Bobby Cowley: Paying it Forward for Our Parks

Elaine and Bobby Cowley’s romance began in 1988 in the cool clear waters of the spring-fed pool at Balmorhea State Park in West Texas.

Read More

Byron Black: Making Long-Term Plans for the Future of Our Parks & Wildlife

Byron Black: Making Long-Term Plans for the Future of Our Parks & Wildlife

Byron Black has lived an adventurous life. He was born in Georgia, and when he was but an infant, his parents would load him up in their Volkswagen Bug for outdoor adventures in Georgia State Parks.

Read More

Kay & Rick Kingelin: Giving Back to the Parks That Have Given So Much

Kay & Rick Kingelin: Giving Back to the Parks That Have Given So Much

Kay Kingelin and her husband Rick love to spend time outdoors. About 15 years ago, after they had both retired from their professional careers, they uprooted themselves from Houston, which had been their home for decades.

Read More

Lucy Weber: Ensuring the Future of Our Parks

Lucy Weber: Ensuring the Future of Our Parks

Lucy Weber loves spending time in Texas State Parks. Now that she has retired, she has more time for park visits and is on a personal mission to visit every state park in Texas.

Read More

Margaret Martin: Planning for the Future

Margaret Martin: Planning for the Future

Margaret Martin grew up on a South Texas Ranch near Laredo where her experiences connected her to nature in a way that inspired her lifelong commitment to conservation. Always active in her community, Margaret is a strong believer in the importance of citizen involvement, law enforcement, and collaborating among diverse organizations to benefit all.

Read More

Candy and Steve Allmand: For the Love of Parks and Wildlife

Candy and Steve Allmand: For the Love of Parks and Wildlife

Candy and Steve Allmand are thoroughly enjoying their retirement years together. Their travels take them to many places in the United States, and visiting parks is high on their list of things to do. Whether taking in the breathtaking sight of Mount Rushmore, enjoying bison and other majestic wildlife in Yellowstone, or the quiet beauty and spectacular vistas of Rocky Mountain National Park, the Allmands love the wild things and wild places that make America such a wonderful place to live.

Read More

Esther and Tom Schneider: Giving Back to Texas

Esther and Tom Schneider: Giving Back to Texas

Esther and Tom Schneider are enjoying the next chapter of their lives together in Texas. “While we aren’t native Texans, we got here as soon as we could,” said Esther. “When Tom retired after more than 30 years in commercial development, we knew we wanted to end up in Texas.”

Read More

Honoring Family Memories With a Legacy Gift

Honoring Family Memories With a Legacy Gift

Mary Ann Rao Lancaster has spent her entire life caring about the wild things and wild places of Texas. Her rural upbringing helped inspire her conservation ethic, which is why she has made a decision to support Texas Parks and Wildlife Foundation (TPWF) with a legacy gift.

Read More

A Quiet Admirer of Public Lands Leaves a Remarkable Legacy

A Quiet Admirer of Public Lands Leaves a Remarkable Legacy

Rita Jo Poe spent the latter years of her life crisscrossing the western US in her Airstream trailer. A nature lover and accomplished photographer, Rita dedicated her final years to living among the iconic landscapes and wildlife of America’s national and state parks and wildlife refuges. Now, Rita’s love of wild things and wild places is memorialized through an astonishing legacy.

Read More

Paying it Forward

Paying it Forward

Growing up on the Gulf Coast, some of Sharon Lout's fondest memories are of the outdoors, like teaching her brothers how to bait fishing hooks and searching for shells on the beach near her childhood home.

Read More

Taking Care of Texas for Future Generations

Taking Care of Texas for Future Generations

Wayne Collins credits his love of the outdoors to his boyhood experiences in scouting. As a Boy Scout, he participated in camping and canoe trips that laid the foundation of his conservation ethic.

Read More

Supporting the Next Generation of Park Leaders

Supporting the Next Generation of Park Leaders

George Bristol has spent most of his adult life devoted to parks. In 1961, he was a student at the University of Texas and took a summer job on a trail crew at Glacier National Park.

Read More

Leaving a Land Legacy

Leaving a Land Legacy

For some Texans, family land and property may be one of the most significant assets they possess. Considering what will happen to your real estate after your lifetime is an important decision to make.

Read More